Thinking about buying a jet before the year’s end? Here’s everything you need to know.

The fourth quarter of 2024 is primed to be a busy time for private jet acquisitions. Buyers are taking advantage of greater stock, lower prices, and tax benefits that sundown at year’s end.

If you have jet ownership on your holiday list, you need to act fast. There will no doubt be a mad dash for brokers’ services and the mechanics who complete pre-purchase inspections.

Even in a busy buying season, Global Air Charters can help you expertly navigate the used jet market. If you need a trusted advisor for your next airframe acquisition, contact us today to learn which strategies will make your purchase a success.

We’ve written extensively about this topic and have assembled our best pieces of advice for your jet purchase. Here’s what you need to know about purchasing a private jet in Q4 of 2024.

The Used Jet Market

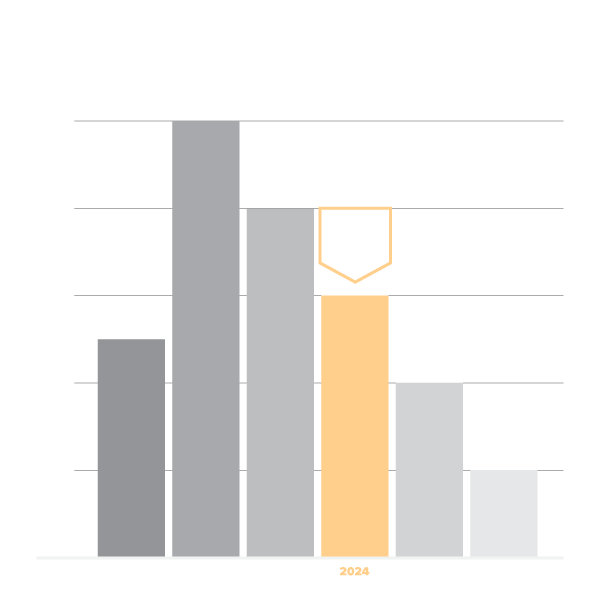

Here’s what the used jet market looks like in 2024. The supply of used jets on the market is ticking back up from its pandemic-era low. Prices are also coming down, coinciding with a slowdown in private charter demand. That means after four years of sellers dictating terms, it’s becoming a buyer’s market once again.

Dealers and brokers surveyed by the IADA reported completing 554 pre-owned aircraft transactions during Q4 2023 compared to 470 in Q4 2022. The full year-over-year numbers saw similar improvement. This year’s numbers are predominantly forecast to continue this trend.

Take Advantage of Bonus Depreciation

Take Advantage of Bonus Depreciation

Some of the eleventh-hour scramble this year will be jet buyers taking advantage of bonus depreciation. For new jet purchases, the Tax Cuts and Jobs Act (2017) allows for 60% bonus depreciation in 2024 and only 40% in 2025.

It’s imperative that all jet buyers calculate the natural depreciation of the asset into their financial plan. There are a few ways to estimate this loss in value, based on your tax strategy or ownership structure. Failure to account for this change could upend your investment.

Know the True Cost of Jet Ownership

Before you buy, make sure you consider the ongoing operating costs of jet ownership. Here’s a sobering thought: you’ll likely spend 20% of the purchase price every year in fixed costs to maintain the aircraft.

This makes it all the more important that you consider which type of jet you can afford. Every airframe type, from midsize to ultra-long-range heavy jets, has its pros and cons. Having a detailed plan of how you’ll use the airframe can help determine which size is right for you.

Have a Financial Plan

Some of the greatest pitfalls in buying a private jet can be alleviated by having a solid financial plan for the life of your investment. We’ve seen buyers take huge losses by not understanding the tax implications, choosing the wrong financing options, and not understanding the jet’s eventual resale value.

Assemble Your Team

Assemble Your Team

To initiate the purchase of your airframe, you’ll need a team of experts who know the details of such a complicated sale. We recommend finding a sales broker, finance broker, and specialized attorney with experience in private aviation. They can ensure you find the best investment opportunity, have the proper monetary strategy, and understand the contractual details.

Income Generation

There are strategies to help boost your return and at least offset the costs of jet ownership.

Clients often ask us how to maximize their return on investment. We suggest exploring different ownership arrangements that help spread the costs around while each party maintains the privileges of ownership.

But the best way to offset your ownership costs is by adding your airframe to the Part 135 certificate of a reputable charter operator. Choosing a jet that will be attractive on the charter market is a specialty of Global Air Charters. Contact our airframe acquisition team today to learn how chartering your jet can help your investment.